This website utilizes anonymous usage data to provide the most helpful experience for visitors. Information about how the site is accessed is stored and analyzed without identifying individual users. This allows our team to understand which sections of the website are found most useful so we can focus our efforts on improving those areas for all users. We respect the privacy of those who access our content and aim to make the site as beneficial as possible for everyone.

- Crypto Betting

-

-

Crypto Available

First Deposit Bonus 125% Up To $1000

100% up to $100 (or equivalent in crypto)

-

- eSports Betting

-

-

Crypto Available

First Deposit Bonus 125% Up To $1000

100% up to $100 (or equivalent in crypto)

-

- By Sport

-

-

Crypto Available

First Deposit Bonus 125% Up To $1000

100% up to $100 (or equivalent in crypto)

-

- By Type

-

-

Crypto Available

First Deposit Bonus 125% Up To $1000

-

- SportsBooks

-

-

Crypto Available

First Deposit Bonus 125% Up To $1000

100% up to $100 (or equivalent in crypto)

-

- Odds & Picks

- Education

How Do Sport Betting Taxes Work?

Taxes are an integral part of the wagering experience, regardless of the size of the winnings. Do you have to pay taxes on sports betting? Well, the answer is yes. In the United States, bettors are obliged to report their winnings to the federal government on their own. That is why it is crucial to keep track of both winnings and losses to be able to complete task forms correctly when the time comes. Navigating sports betting taxes may be a really daunting task, but as an experienced betting expert, I am here to provide you with valuable guidance on every step.

Tax On Sports Betting Winnings

Unlike in the UK or Canada, there are no exclusions from taxes on sports betting in the USA. If your total gains from sports betting, after subtracting losses, surpass $600 in a year, you are required to pay taxes on those winnings. This applies to various forms of gambling, such as lotteries, casino games, scratch cards, and more. This $600 threshold includes all your net profits from sports betting, regardless of any losses you may have incurred. While you can deduct your betting losses from your taxes, they do not change the $600 tax requirement limit.

To report your sports betting earnings for tax purposes in the USA, you will need to use Form 1040 and Schedule A. On Form 1040, you will enter your entire earnings from sports betting under “Other Income,” specifically on line 21. Taxes on betting are calculated based on your net winnings, which are your total winnings minus your losses. For example, if you won $500 but lost $1000, you can subtract the $500 loss. Drawing from my practical experience, I highly advise keeping detailed records of all your wagers, including wins and losses, for tax considerations.

If you are wondering how much sports betting taxes are, the answer varies based on a number of variables, such as where you live, how much you win, and whether you qualify as a professional or recreational bettor. For instance, wins from sports betting in the US are usually liable to federal income tax, which varies from 10% to 37%, depending on your filing status and total taxable income. States may also levy their own taxes on gains from gambling.

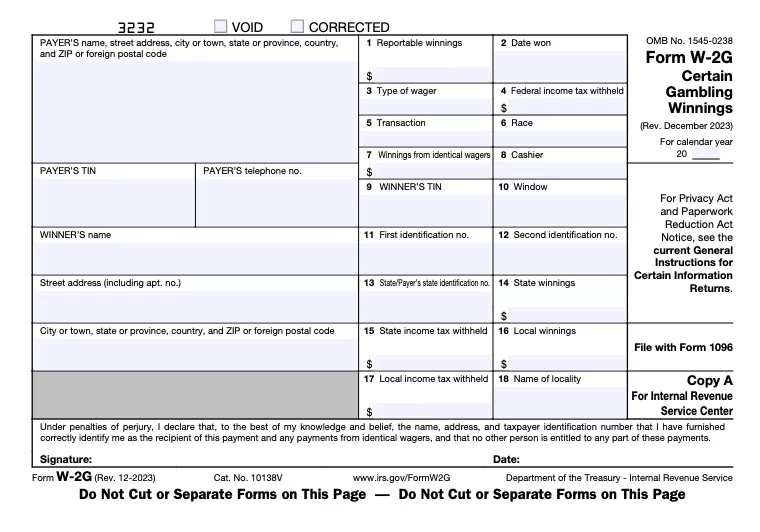

Form W-2G

This is a crucial document that is used for reporting profits from gambling and any related tax withholdings. It is usually given to clients who have won large sums of money that must be reported to the IRS by casinos and other gaming establishments. It contains vital information, such as the total winnings, dates of winning, type of wager, and any federal and state income tax already withheld.

This form is based on your total wins and losses within a 24-hour period, rather than annually. Typically, your bookmaker mails this to you directly. In specific situations, online sportsbooks and casinos are obligated to issue these forms and withhold 24% in federal taxes.

In the US, all earnings from gambling are taxable, but only certain winnings that meet specific criteria are reported on Form W-2G. For instance, if sports betting winnings are between $600 and less than $5,000, they are taxable, but the bookmaker does not withhold any taxes for sports betting. However, if the winnings surpass $5,000, immediate taxation applies, and the bookmaker must withhold taxes.

Specific thresholds determine when a Form W-2G is required. For instance, winnings exceeding $600 in horse racing, $1,200 in bingo or slot machines, $1,500 in keno, or $5,000 in poker tournaments trigger this requirement. However, table games like blackjack are exempt from the W-2G requirement, although winnings from these games still need to be reported and taxed accordingly.

Deduct Your Losses

You are able to subtract losses from your taxes on betting if you list them on Schedule A. You can reduce losses in accordance with certain standards, but you cannot subtract the cost of your wager from your earnings in order to determine your net profit. You must categorize your deductions on your tax return in order to claim these losses as a tax deduction, even if doing so means that you cannot claim the standard deduction due to your filing status. Furthermore, the amount of losses you can deduct is restricted to the total of your reported gains from gaming.

For example, your deduction is restrained to $3,000 if you won $3,000 but lost $6,000 instead. The leftover $3,000 cannot be used to reduce any other taxable income that you may have. Rather, you have to file Form 1040, declare wins of $3,000, and claim $3,000 as an itemized deduction separately.

State Tax

My research shows that residents of New Hampshire, Texas, South Dakota, Washington, Alaska, Florida, Tennessee, or Wyoming are not obligated to pay state taxes on online sports betting. Federal income tax is still due and payable to the IRS, though. Residents living outside of these states are required to disclose winnings from sports betting on their state tax filings. Drawing from my experience, I can say that the process typically resembles federal tax payment. By the way, if you have paid taxes for sports betting winnings in a different state, you are still required to report those winnings to your home state. However, you typically receive a deduction or credit for taxes paid to a non-resident state.

Tax for Non-Residents

How do taxes work on sports betting when you are not a resident of the USA? Well, bettors who are not residents of the United States are also required to disclose their financial gains from gambling to the IRS, typically taxed at a rate of 30%. These winnings should be reported using Form 1040NR.

Why Do We Have To Pay Tax On Sports Bets?

The reason for paying taxes on online sports betting is rooted in the pursuit of financial gain, which motivates both sportsbook owners and individual bettors. As a substantial amount of money flows through gambling activities each year in the United States, taxation becomes essential. Taxes on bettors’ winnings serve as significant contributions to state economies nationwide, often funding various public endeavors like education and infrastructure projects. Well, if everything written above did not convince you in any way, then know that I was not convinced either. However, the fact remains that we must pay taxes on gambling activities.

Sportsbooks’ Position On Paying Taxes On Your Winnings

Sportsbooks expect bettors to take responsibility for paying sports betting taxes on their winnings. These platforms are global in their consumer base but have neither the ability nor the authority to help with matters related to taxes. In other words, sportsbooks avoid any liability for customers who mishandle their tax obligations.

Can You Avoid Reporting Winnings If You Don’t Withdraw From Sportsbook?

I strongly advise against this approach in any scenario. There is a misconception circulating that online sports betting winnings are not subject to taxation if left untouched in the bettor’s online sportsbook account. However, this notion is entirely false. The IRS taxes individuals based on income that is accessible to them, regardless of whether they physically possess it.

Whether funds remain in an online sportsbook account or are transferred to a bank, the IRS treats them as taxable income for US citizens. Moreover, the jurisdiction of where the bets are placed, whether offshore or not, does not exempt individuals from reporting winnings.

It is crucial to understand that dealing with the IRS can be a cumbersome and unpleasant experience, and attempting to evade taxes on sports betting is not advisable under any circumstances.

What Would Happen If You Didn’t Report Winnings?

I think that the likelihood of being imprisoned for failing to report winnings is minimal. However, there are legal risks associated with incorrectly completing tax forms, with hefty fines and audits being more common consequences. Penalties for fraudulent or inaccurate filings can reach $250,000, and in severe cases, criminal charges and a maximum three-year prison sentence may be imposed by the IRS. Even minor unreported amounts can lead to fines of up to $5,000 plus 100% of any unpaid taxes. Because of the possible consequences, it is therefore not advised to record winnings incorrectly.

Conclusion

Summing up, understanding and adhering to your tax obligations related to sports betting is essential for maintaining compliance with the law. However, paying your taxes does not have to be a complicated process. In fact, it is quite simple, especially if you are diligent about keeping track of your gambling wins and losses. With my comprehensive guide, you may rest assured and confidently navigate the complexities of sports betting taxes.